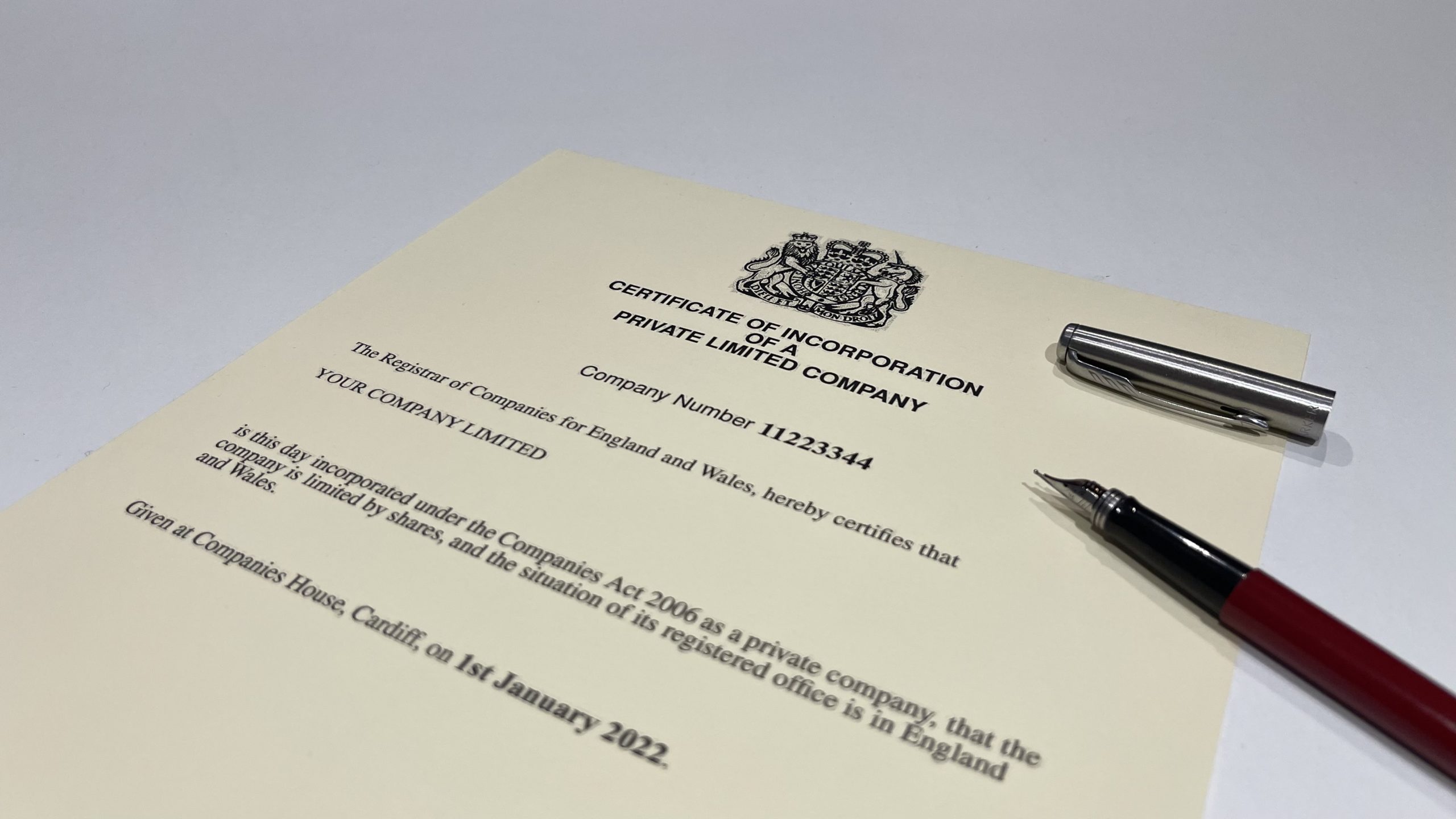

In the United Kingdom, a certificate of incorporation is an official legal document that confirms the formation of a limited company. It provides vital information about the company, including its name, registration number, date of incorporation, and its legal status. Obtaining a certificate of incorporation is a crucial step for any business owner who wishes to form a limited company in the UK. In this blog post, we will take a closer look at what a UK company certificate of incorporation is, why it’s essential, and when it might be required for business purposes.

What is a UK company certificate of incorporation?

A certificate of incorporation is a legal document issued by Companies House, the official government registrar of companies in the UK. It confirms that a new company has been registered and recognized by law. The certificate includes essential information about the company, such as its name, registered office address, company number, and date of incorporation. It also states the company’s legal status, whether it’s a private limited company (Ltd), a public limited company (PLC), a limited liability partnership (LLP), or another type of legal entity.

Why is a certificate of incorporation essential?

Obtaining a certificate of incorporation is a necessary step for any business owner who wants to form a limited company in the UK. It serves as proof that the company exists and is legally recognized by the UK government. Without this document, a company cannot conduct business or enter into legal contracts.

In addition to serving as proof of the company’s existence, a certificate of incorporation also provides essential information that potential investors, creditors, and customers may want to know about the company. It gives information about the company’s legal status, its date of incorporation, and the names of its directors and shareholders. This information is crucial for anyone who wants to do business with the company or invest in it.

When might a UK company certificate of incorporation be required for business purposes?

There are several situations where a UK company certificate of incorporation may be required for business purposes. Let’s take a closer look at some of the most common scenarios:

Opening a bank account:

If a company wants to open a bank account, it will typically need to provide a certificate of incorporation to the bank as proof that the company exists and is legally recognized. This is essential because banks are required by law to verify the identity and legal status of their customers.

Applying for credit:

When a company applies for credit, such as a business loan or credit line, lenders will typically require a certificate of incorporation as part of their due diligence process. This helps them to verify the legal status of the company and assess its creditworthiness.

Entering into contracts:

When a company enters into a contract, it’s essential that both parties understand the legal status of the company. Providing a certificate of incorporation to the other party can help to establish the company’s legal existence and status.

Applying for licenses and permits:

Many businesses require licenses and permits to operate legally in the UK. To apply for these licenses and permits, the company may need to provide a certificate of incorporation to the relevant regulatory body as proof of its legal status.

Hiring employees:

When a company hires employees, it’s essential that it has a legal status and can provide proof of its existence. A certificate of incorporation can help to establish this and is often required by employers when conducting pre-employment checks.

Conclusion

In summary, a UK company certificate of incorporation is an essential legal document that confirms the formation of a limited company. It provides vital information about the company, including its name, registration number, date of incorporation, and legal status. Obtaining a certificate of incorporation is a crucial step for any business owner who wishes to form a limited company in the UK.